40 what is a non qualified retirement plan

Investments in Collectibles in Individually Directed ... Retirement Topics – Investing Plan Assets; Retirement Plan Investments FAQs; Analysis. The acquisition by an individually-directed account under a qualified plan of a “collectible” is treated as an immediate distribution from such account in an amount equal to the cost to the plan of such collectible. See IRC Section 408(m). Non-Qualified Plan Definition & Example - InvestingAnswers A non-qualified retirement plan is essentially whatever a qualified plan is not. In other words, if the plan does not meet the myriad of exact requirements the Internal Revenue Code section 401(a) and the Employee Retirement Income Security Act of 1974 (ERISA) , the retirement plan is non-qualified.

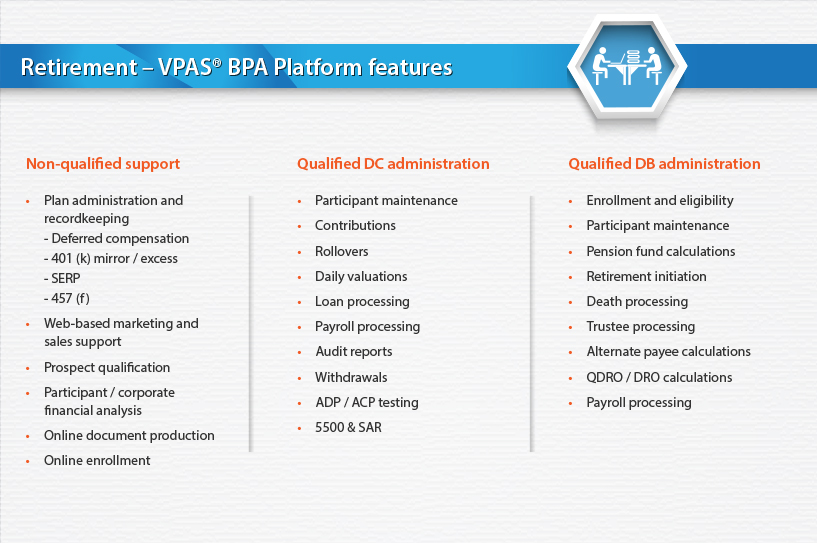

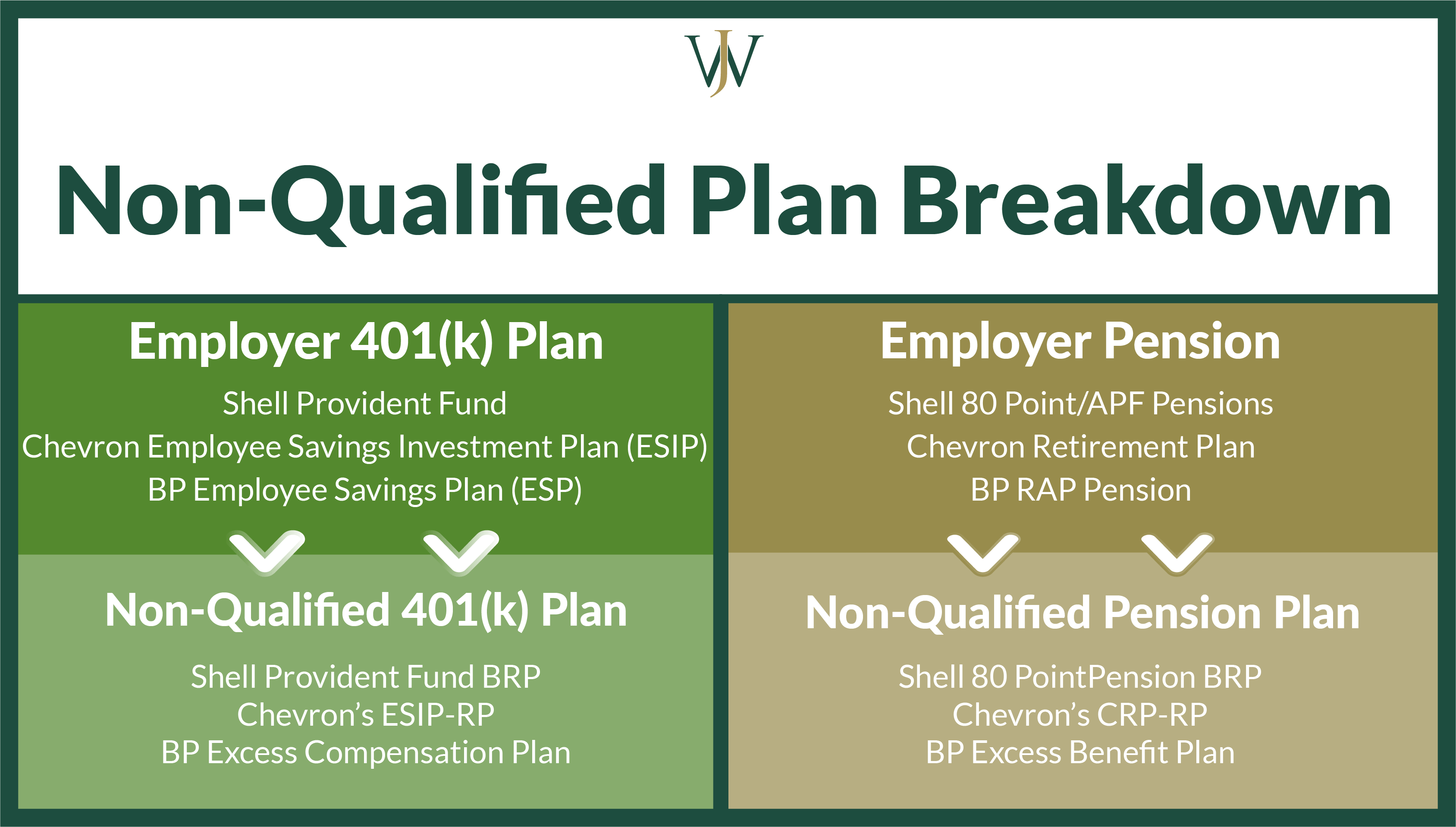

Qualified Retirement Plan: What Is It & How It Works ... Examples of non-qualified plans include an individual retirement account, deferred compensation plan, 457 (b) plan, split dollar life insurance, salary deferral, Roth IRA or executive benefit plan. When it comes to contribution limits, those will vary by plan type.

What is a non qualified retirement plan

Non-Qualified Retirement Plan - Definition, Benefits ... Non-qualified plans can accomplish several objectives for employers that cannot be achieved with qualified plans, such as: Providing additional compensation for a key employee without surrendering control of the business. Nonqualified Retirement Plans: What Are They? | The Motley ... Nonqualified retirement plans are employer-sponsored retirement plans that aren't subject to the rules laid out in the Employee Retirement Income Security Act of 1974 (ERISA). This law created... Retirement Topics - Qualified Joint and Survivor Annuity ... 28.9.2021 · Retirement Topics - Qualified Joint and Survivor Annuity A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant’s surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO

What is a non qualified retirement plan. Qualified vs. Nonqualified Retirement Plans: What's the ... What Is a Nonqualified Retirement Plan? Many employers offer primary employees nonqualified retirement plans as part of a benefits or executive package. 4 Nonqualified plans are those that are... What are some non-qualified retirement plans ... What is a non-qualified supplemental executive retirement plan? A SERP is a non-qualified retirement plan offered to executives as a long term incentive. Unlike in a 401(k) or other qualified plan, SERPs offer no immediate tax advantages to the company or the executive. When the benefits are paid, the company deducts them as a business expense. What does a non qualified retirement plan mean? - JacAnswers The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans. Nonqualified plans can help select employees to save more ... There are several reasons to consider sponsoring a nonqualified plan: NQDC plans can help improve employee retention and results by tying benefits to future service and performance. You can help highly compensated employees save more than the IRS IRC, Section 415, limits allow. Payments can be of any amount, making it an effective way to offer ...

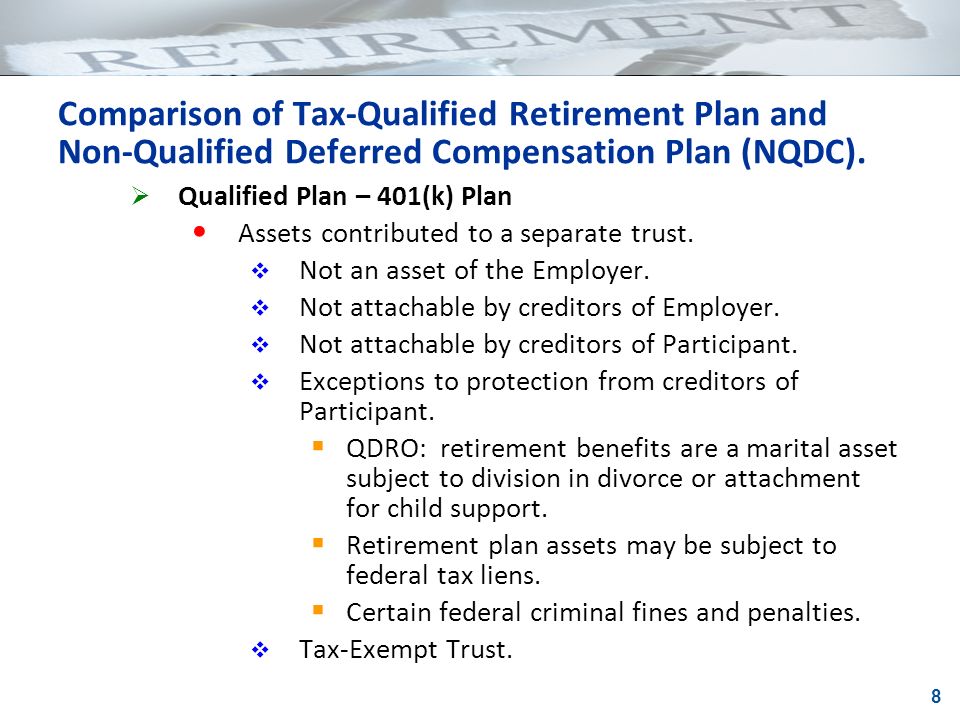

› terms › qQualified Retirement Plan - Investopedia Sep 24, 2020 · A qualified retirement plan meets the requirements of Internal Revenue Code Section 401(a) of the Internal Revenue Service (IRS) and is thus eligible to receive certain tax benefits, unlike a non ... What Is a NonQualified Retirement Plan? - Experian Be Prepared. Nonqualified retirement plans can help highly compensated executives save enough to maintain their lifestyles in retirement. Before participating in a nonqualified retirement plan, however, max out your other employer-sponsored retirement plans and tax savings vehicles such as flexible spending accounts.Make sure you clearly understand the terms, risks and tax consequences of any ... What is a Non-Qualified Retirement Plan? (with pictures) Non-qualified retirement plans are deferred compensation plans that allow the employee to delay receiving earned wages and income until a later date. The employer is charged with the responsibility of maintaining the deferred income in a special fund until the employee retires or otherwise leaves the company. › qualified-vs-non-qualifiedQualified vs. Non-Qualified Plans: What's the Difference? Nov 17, 2021 · Qualified retirement plans give employers a tax break for any contributions they make. Employees also get to put pre-tax money into a qualified retirement plan. All workers must get the same opportunity to benefit. A non-qualified plan has its own rules for contributions, but it offers the employer no tax break.

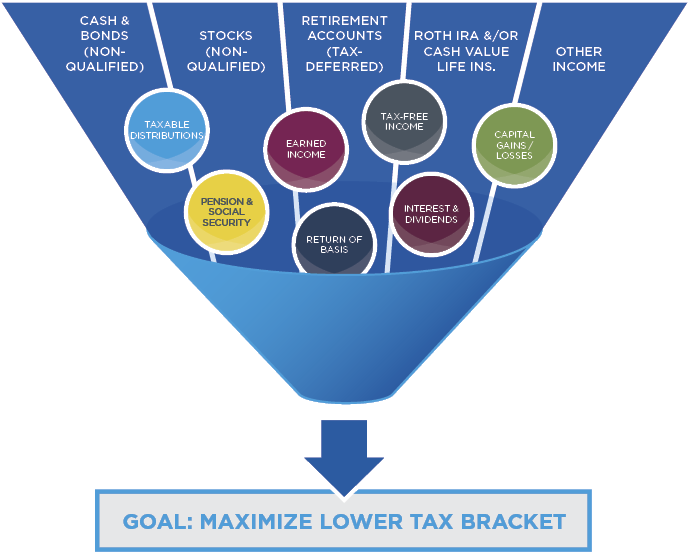

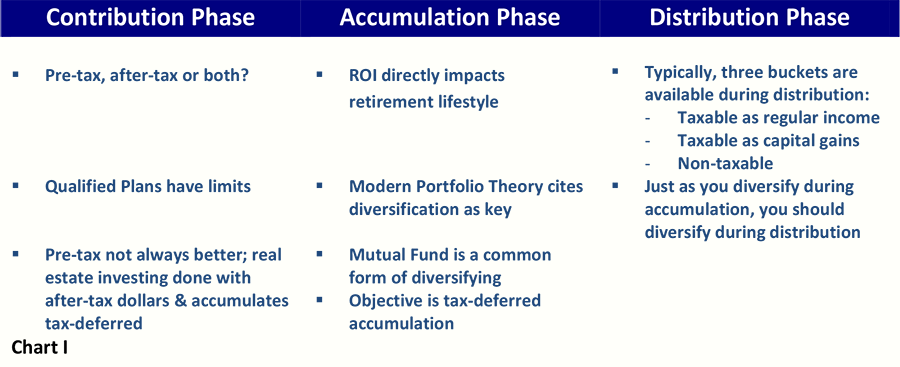

Qualified vs Non Qualified Retirement Plans: What's the ... Non Qualified money is "after tax" money. When you invest outside of a "Qualified" plan, you do not get to write off this investment on your taxes. Put simply, money invested into Non Qualified plans will not get an upfront tax break. Additionally, the investment earnings could be taxable each year. It all depends on the type of investment you use. A Guide to Common Qualified Plan Requirements | Internal ... Under Code section 410 (a) (4), a plan is not qualified unless it provides that an employee who is otherwise eligible to participate under the terms of the plan commences participation no later than the earlier of: › ira-qualified-planIs an IRA a Qualified Plan? - Investopedia Dec 13, 2021 · A qualified retirement plan is an investment plan offered by an employer that qualifies for tax breaks under the Internal Revenue Service (IRS) and ERISA guidelines. merrillconnect.iscorp.com › nlg › viewDocumentAnnuity & Qualified Retirement Plan Insurance Withdrawal ... Section 4 - For Qualified Accounts Only (Not applicable to IRAs or Non Qualified accounts) 4a. Qualifying Events - May require proof of eligibility: Attainment of age 59½ (70½ for 457(b) gov't plans) Separated from employment. Employer Terminated Retirement Plan Active-Duty Reservist. Disabled Unforeseeable Emergency/Financial Hardship.

Non-Qualified Plan - Overview, How It Works, Types A non-qualified plan is an employer-sponsored, tax-deferred retirement savings plan that falls outside the Employment Retirement Income Security Act (ERISA). Unlike qualified plans, non-qualified plans are exempt from the regulations and testing that apply to qualified plans.

ttlc.intuit.com › community › retirementIs military retirement pay from a qualified or nonqualified plan Jun 01, 2019 · Military retirement is considered a non-qualified plan. The term "qualified retirement plan" applies to plans covered by the Employee Retirement Income Security Act, or ERISA. ERISA only covers private sector retirement plans. The law does not cover public sector pensions including federal government plans such as the military retirement system.

Non-Qualified Annuity: The After-Tax Retirement Annuity (2022) Non-Qualified Annuity Features and Benefits Purchased with after-tax funds No contribution limits Only your earnings are taxed as income; your principal is not No Required Minimum Distributions (RMD) A non-qualified annuity is a type of investment you buy with the money you have already been taxed on.

What is a Non-Qualified Retirement Plan? Non-qualified retirement plans aren't subject to the same strict rules as qualified plans. One of the main differences between the two is contribution limits. Contributions to qualified 401 (k) and 403 (b) plans are capped at $19,500 in 2021, the same as 2020.

Nonqualified Plan Definition A nonqualified plan is a type of tax-deferred, employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act (ERISA) guidelines. Nonqualified plans are designed...

Non-Qualified Retirement Plans - pacificpensions.com A Non-Qualified Retirement Plan is a systematic pre-arranged method of accumulating retirement assets that is not registered with nor regulated by the Internal Revenue Service. • Contributions to a Non-Qualified Plan generally are not deductible until distribution. • Participation in the Plan is determined by the employer and may include as ...

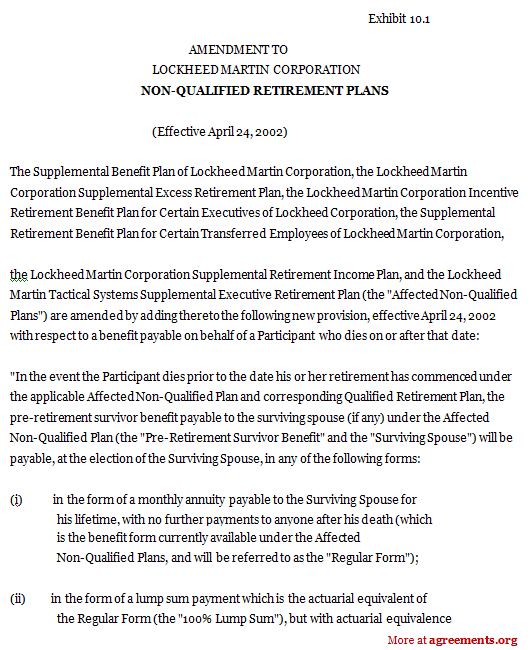

Nonqualified Deferred Compensation Plans (NQDCs ... 16.12.2021 · Unlike a qualified plan, where benefits are segregated from the employer's general assets, your deferred compensation deferred into the NQDC remains in the employer's general assets and is subject to potential loss. The plan essentially represents a promise by the company to pay you back.

Non qualified pension plan distribution A nonqualified deferred compensation (NQDC) plan is an arrangement that an employer and employee agree to where the employer accepts to pay the employee sometime in the future. Executives often utilize NQDC plans to defer income taxes on their earnings. They differ drastically from qualified plans, like 401 (k)s.

Non-Qualified Plans | A Powerful Tax & Retirement Tool OJM's David Mandell, JD, MBA reviews the benefits of non-qualified plans for tax reduction and retirement for physicians and business owners.

What are Non-Qualified Plans (W-2)? | BambooHR The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans.

Qualified vs. Non-Qualified Benefit Plans Additionally, according to Investopedia, a non-qualified employee benefit plan: Includes plans known as deferred-compensation, group carve-out plans, split-dollar life insurance and executive bonus plans. Has no limit on contributions from the employer.

Retirement Plan Services | Fiduciary Outsourcings Services ... Retirement Plan & Fiduciary Solutions. Fiduciary Solutions; Flexible Plans & Partnerships; TPA & 3(16) Solutions; MEPs PEPs & GoPs Solutions; Consulting Solutions; Retirement Plan Solutions Team; What Our Clients Have to Say About Us; Non-Qualified Plan & Benefits Financing Solutions. Our Non-Qualified Retirement Plan Solutions; Our Benefits ...

What is a non qualified pension plan Non-qualified plans are retirement savings plans. They are called non-qualified because they do not adhere to Employee Retirement Income Security Act (ERISA) guidelines as with a qualified plan. Non-qualified plans are generally used to supply high-paid executives with an additional retirement savings option.

Implementation Project Specialist Non-Qualified Retirement ... Newport offers comprehensive plan solutions and consulting expertise to plan sponsors and the advisors who serve them. As a provider and partner, Newport is independent, experienced and responsive. Job Description: Newport has an excellent opportunity for an Implementation Project Manager for Non-Qualified Retirement Plans.

Non-Qualified Retirement Plan: Types & Examples | Study.com A non-qualified retirement plan is a retirement program that doesn't meet Employer Retirement Income Security Act (ERISA) standards. An ERISA qualified account would include a typical retirement...

What Is The Difference Between Qualified And Non-Qualified ... What Is The Difference Between Qualified And Non-Qualified Pension Plans?

What Does "Nonqualified Retirement Plan" Mean? | Finance ... A "nonqualified" retirement plan is an account that may be offered by your employer (or an account that's offered by a plan administrator), which does not hold tax-deferred money in your account;...

Retirement Topics - Qualified Joint and Survivor Annuity ... 28.9.2021 · Retirement Topics - Qualified Joint and Survivor Annuity A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant’s surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO

Nonqualified Retirement Plans: What Are They? | The Motley ... Nonqualified retirement plans are employer-sponsored retirement plans that aren't subject to the rules laid out in the Employee Retirement Income Security Act of 1974 (ERISA). This law created...

Non-Qualified Retirement Plan - Definition, Benefits ... Non-qualified plans can accomplish several objectives for employers that cannot be achieved with qualified plans, such as: Providing additional compensation for a key employee without surrendering control of the business.

0 Response to "40 what is a non qualified retirement plan"

Post a Comment