41 defined benefit pension plans disappearing

Defined Benefit vs Defined Contribution (Difference) | Zurich Ireland A defined benefit pension plan (DB) sets out the specific benefit that will be paid to a retiree. This calculation takes into account factors such as the number A defined contribution pension (DC) is an accumulation of funds that makes up a person's pension pot. A person contributes a portion of their... How do I value a Defined Benefit Pension Plan? : personalfinance Defined benefit pension plans are a rare and valuable thing. Read up on your pension fund to learn if it's conservatively run and reliable. I'm vested in two civil service defined benefit plans (state and municipal). The projected payout is reasonable and both funds appear well-managed.

Best Defined Benefit Pension Plan in US - Pension Deductions Best defined benefit plan permits large benefits to an individual or small business owner and can provide significant tax deductions. Every defined benefit plan requires a plan document which will list all assumptions of the pension plan and ensure compliance with all IRS rules and regulations.

Defined benefit pension plans disappearing

2022 Defined Benefit Plan Contribution Limits: Rule to $1 Million Defined benefit plans have become popular for the self-employed. The plans are set up to provide a predetermined retirement benefit to employees (or Pension benefits can be paid out as a monthly benefit or even as annual payments. There are additional compliance issues if the plan is covered... (PDF) A New Defined Benefit Pension Risk Measurement Methodology Defined benefit pension plan sponsors have taken on greater risks for sponsoring these plans in the last several years. Due to ever increasing concerns of longevity risk and the weak economic environment, sponsors are eager to understand their pension-related risks to facilitate optimal... Pensions Aren't Dead: Defined Benefit Plans Gains Fans How Defined Benefit Pension Plans Help Cut Taxes. If a business has a defined benefit pension plan, the owner can contribute much more to a retirement plan than he or she could with a defined contribution plan like a 401k. This can help reduce business income below the level required to get...

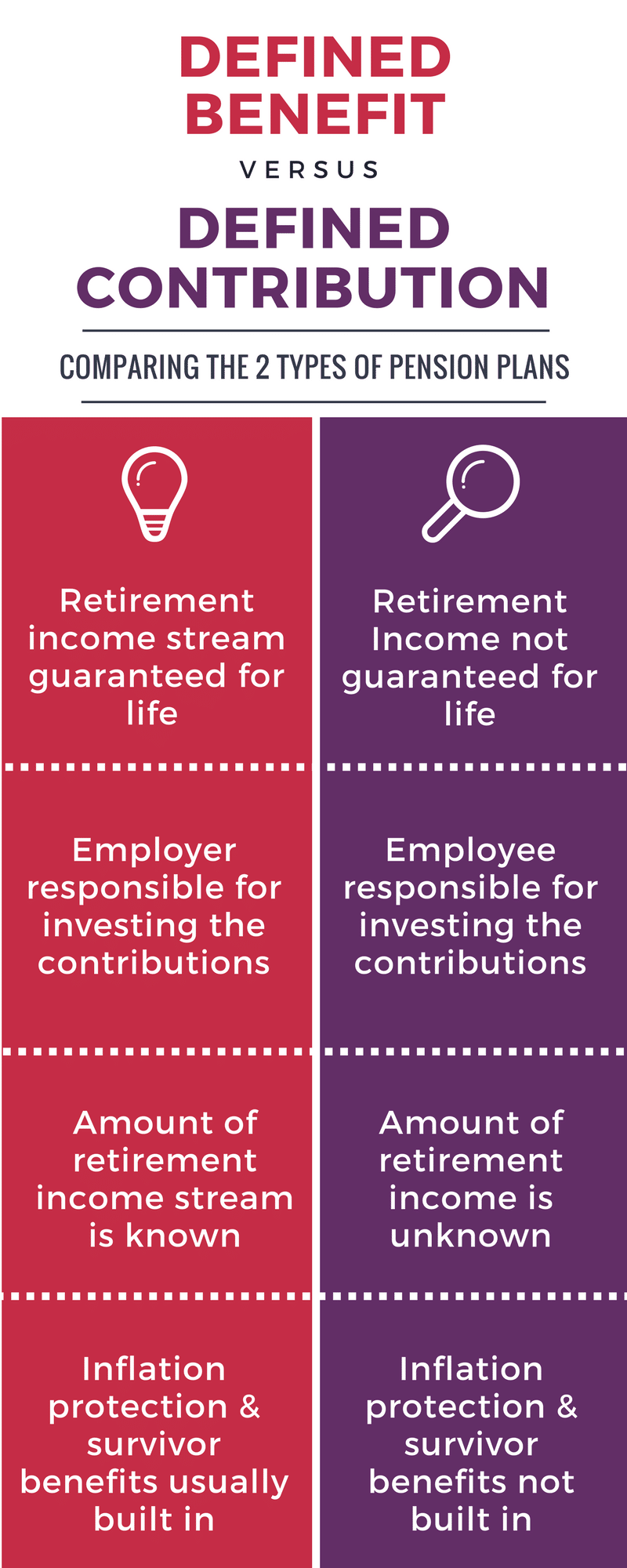

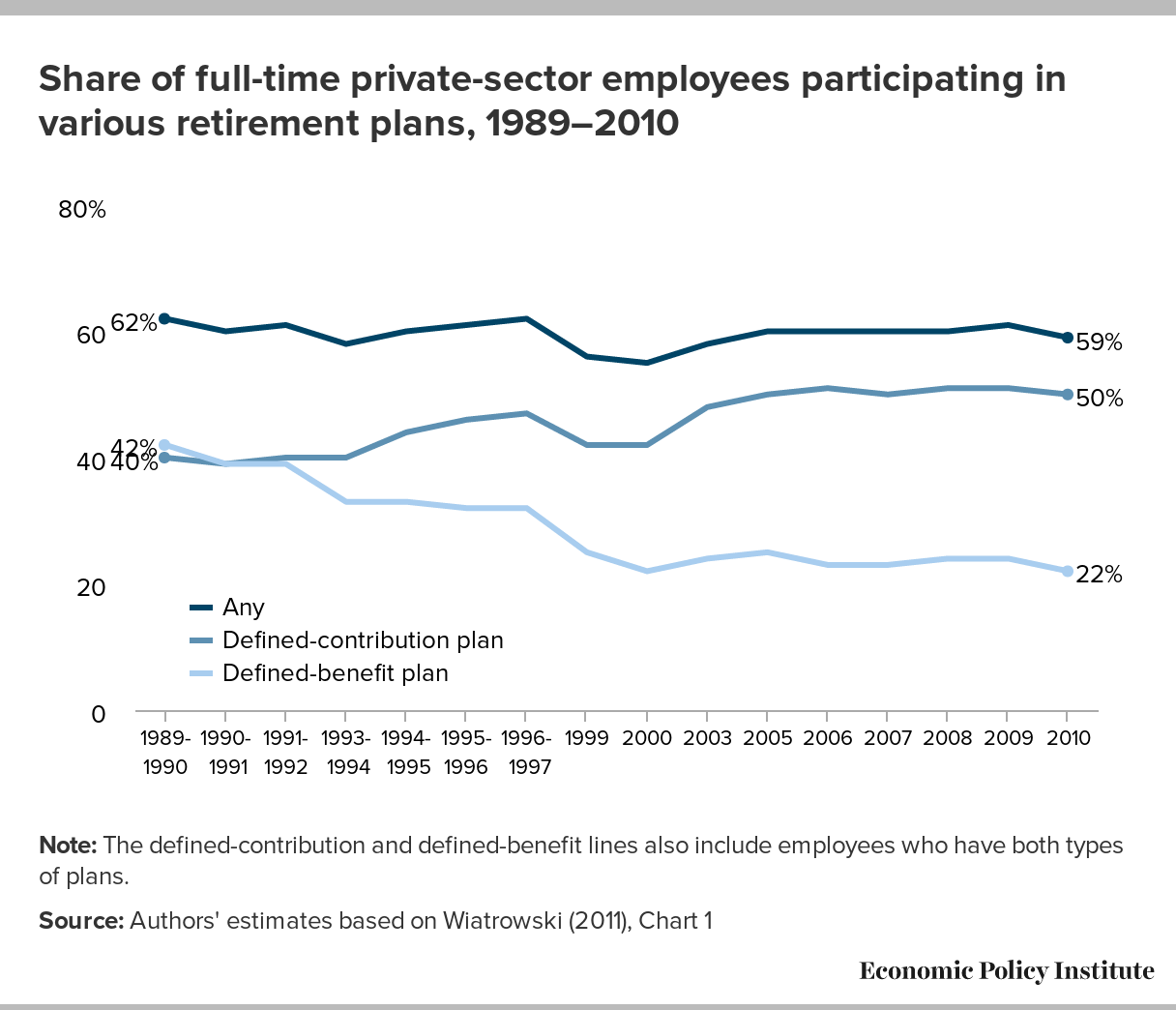

Defined benefit pension plans disappearing. 2. Defined Benefit Plans A defined benefit plan is what most of us commonly refer to as a 'pension'. These plans offer guaranteed automatic payouts in retirement based on a formula that usually takes into account your salary Eliminating the Security of Pensions. Unfortunately, stories like my father's are disappearing. › mbachnak › retirement-planning-pptRetirement Planning PPT - SlideShare Jun 25, 2012 · Keogh Plan- A tax deferred pension plan available to self-employed individuals or unincorporated businesses for retirement purposes. A Keogh plan can be set up as either a defined-benefit or defined-contribution plan, although most plans are defined contribution. Angst in America, Part 4: Disappearing Pensions - Mauldin Economics Defined-benefit plans are generally the old-style pensions that came with a gold watch and guaranteed you some level of benefit for the rest of your life. What about private-sector pensions? As noted, defined-benefit plans are disappearing, but many companies still have legacy plans... PDF Why have defined benefit plans A traditional defined benefit plan pays a lifetime annuity at retirement that is generally a percentage of final salary for each year of service. With respect to pensions, the significantly greater level of unionization in the public sector has surely contributed to support for defined benefit plans.

The Demise of the Defined-Benefit Plan Defined-benefit plans are a thing of the past for most private-sector workers, but there are other ways to shore up your retirement. Changes for Defined-Benefit Plans. Putting the Freeze on Pensions. Shift to Defined Contribution Plans. Fending for Yourself. What are the downsides of a defined benefit pension plan? - Quora Defined benefit pension plans are one of the best options from the perspective of the private sector retiree. Plans funded and fielded in the private The pension is rapidly disappearing, because it's risky. If you want to balance your risk portfolio, you distribute risk, and the defined contribution does... Will the defined benefit plan disappear? | The Star The defined benefit pension was once a standard. Employers and employees contributed to a plan, and the worker knew at retirement exactly how much the monthly payout Thomas Levy, chief actuary at the Segal Company, doesn't believe the defined benefit pension plan will disappear completely. Defined benefit pension plan - Wikipedia A defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum or combination thereof on retirement that is predetermined by a formula based on the employee's earnings history, tenure of service and age...

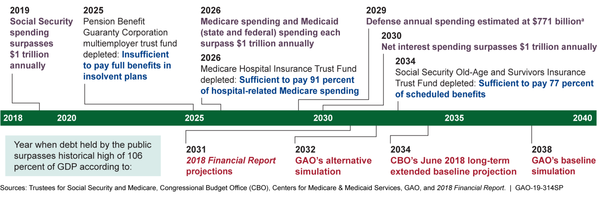

Defined Benefit Pension Plans | Mercer If you manage a defined benefit plan today, you face a volatile market, uncertain liabilities and regulatory complexity. Mercer can help you seize opportunities and manage risk. When it comes to managing pension risk, companies and their executives seem to have ravenously consumed the... Are Defined Benefit Pensions Disappearing? Defined Contribution Pensions vs Defined Benefit Pensions. Alongside the state pension — which everyone who's made sufficient National Insurance contributions receives from the Defined benefit pension plans are sometimes known as final salary pension schemes or career average pensions. The Fed - Are Disappearing Employer Pensions Contributing to... "Private Defined Benefit Pension Plans in the U.S. National Accounts: Accrual Measures for the 2013 Comprehensive Revision," U.S. Bureau of Economic Analysis. Sabelhaus, John, and Alice Henriques Volz (2019). "Are Disappearing Employer Pensions Contributing to Rising Wealth Inequality... › retirement › social-securityUnderstanding Social Security Benefits - The Motley Fool Dec 02, 2021 · Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that.In a nutshell, Social Security is designed to support disabled and ...

› policy › docsSocial Security Retirement Benefits and Private Annuities: A ... The benefit can be calculated based on those factors alone. 18 As employer-sponsored retirement plans continue to shift from DB to DC plans, it is important for individuals and policymakers to understand both the significance of a steady income stream throughout retirement and the pros and cons of the various sources of retirement income.

PDF The Disappearing Defined Benefit Pension and Its Potential Impact... If frozen plans were supplemented with new or enhanced defined contribution (DC) retirement plans, there would be more losers than winners, and The percentage of workers covered by a traditional defined benefit (DB) pension plan that pays a lifetime annuity, often based on years of service and...

What is a defined benefit pension plan? | AccountingCoach A defined benefit pension plan is a retirement plan in which the employer commits to paying a specified monthly payment to each eligible employee when he or she retires at a stated age. The monthly benefit is often based on a formula such as a percentage for each year of employment times...

Defined benefit pension schemes explained - Experts for Expats Learn more about defined benefit pension schemes and the options available to people who either live in the UK or abroad as an expat. In each case, you would need to ask you pension fund directly how much lump sum you would receive from your defined benefit pension scheme.

Defined Benefit Vs. Defined Contribution Pension Plans | Sapling A defined-benefit plan, also called a pension, is a plan that pays you a specific amount of money, either per month or in a lump sum, when you become Defined-benefit plans promise a certain payout based on criteria that the participant can control. Generally, if you work at a job longer, you will...

Step-By-Step Overfunded Defined Benefit Pension Plans Guide An overfunded defined benefit pension plan can present problems. Employers sponsoring a defined benefit plan with only a few participants, especially ones where the benefits have been frozen, are at an increased risk of overfunding.

PDF The shift from defined benefit to defined contribution pension plans... In a defined contribution (DC) pension plan, workers accrue funds in individual accounts administered by the plan sponsor. a DC pension plan; the retirement income that will be provided is unknown in advance. The pension benefit accumulated during the employee's working career will depend on the...

What Is A Defined Benefit Plan? - Forbes Advisor A defined benefit plan, more commonly known as a pension plan, offers guaranteed retirement benefits for employees. Defined benefit plans are largely funded by employers, with retirement payouts based on a set formula that considers an employee's salary, age and tenure with the company.

Defined Benefit Plan Explained | Boomer & Echo A defined benefit plan is a pension that is based on your highest average salary and the number of years of your pensionable service. A company's bankruptcy may also affect pension recipients depending on the status of the plan at the time. If the plan is fully funded at the time, there should be...

Longevity Annuity Contract - QLAC With pension plans disappearing and your health and longevity increasing now is the time to lock in the increased QLAC income payments. Update: June 2019: Retirement is the time you look forward to later in life, the kids are all grown up and now you get the time to do so many of the things you probably put off because of your career.

› terms › pPension Plan Definition Aug 30, 2021 · Allocated Funding Instrument: A specific type of insurance or annuity contract that pension plans use to purchase retirement benefits incrementally. The allocated funding instrument is funded with ...

mustardseedmoney.com › federal-government-pensionWhat is a Federal Government Pension Worth ... - Mustard Seed ... Jul 31, 2017 · There were quite a few other government employees that were also near retirement. They highlighted how wonderful it was to work for the federal government, namely because of the amazing benefits. They specifically expressed how valuable the pension was, particularly in light of the fact that pensions are disappearing outside of the government.

Pensions: A Disappearing Benefit | Kiplinger Look up defined pension plans these days and words you don't want to see associated with the money needed to secure your retirement come up But that does not mean the pension plan will disappear if a company goes bankrupt. Federal law requires that promised benefits should be kept...

Defined benefit plans - YouTube Why defined benefit plans are disappearing These defined benefit programs, however, are becoming increasingly rare. Also, companies are required to send notices to employees if the pension funding is less than 90 percent of liabilities.

Defined Benefit Vs. Defined Contribution Pension Plans - Zacks Defined benefit and defined contribution are very different types of pension plans, and you might be asked to choose which plan you want to participate in for your retirement savings when you start to work at a new company. While fewer companies are offering a defined benefit plan...

Pensions Are Disappearing, Here's How to Save for Retirement Here's why pensions are slowly disappearing in the United States. Think of a pension or a defined benefit plan as a commingled retirement account. The employer (and sometimes its employees) chip in a certain amount of money into a big pool, which is then invested.

› what-is-a-pension-and-how-doWhat Is a Pension? - The Balance Jan 25, 2022 · Pension Benefit Guaranty Corporation. "Your Guaranteed Pension: Single-Employer Plans." Accessed Nov. 21, 2021. Social Security Administration. "The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Baby Boomers." Accessed Nov. 21, 2021. Department of the Treasury.

PDF A Predictable, Secure Pension for Life: Defined Benefit Plans Generally, a defined benefit pension plan requires workers to meet age and service requirements before they can participate in the plan. Workers cannot be excluded from participating because they are too old, even if they are hired within a few years of the normal retirement age specified in the plan.

Pensions Aren't Dead: Defined Benefit Plans Gains Fans How Defined Benefit Pension Plans Help Cut Taxes. If a business has a defined benefit pension plan, the owner can contribute much more to a retirement plan than he or she could with a defined contribution plan like a 401k. This can help reduce business income below the level required to get...

(PDF) A New Defined Benefit Pension Risk Measurement Methodology Defined benefit pension plan sponsors have taken on greater risks for sponsoring these plans in the last several years. Due to ever increasing concerns of longevity risk and the weak economic environment, sponsors are eager to understand their pension-related risks to facilitate optimal...

2022 Defined Benefit Plan Contribution Limits: Rule to $1 Million Defined benefit plans have become popular for the self-employed. The plans are set up to provide a predetermined retirement benefit to employees (or Pension benefits can be paid out as a monthly benefit or even as annual payments. There are additional compliance issues if the plan is covered...

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-45fb62eb90d14d7c834a05988c0b4945.jpg)

0 Response to "41 defined benefit pension plans disappearing"

Post a Comment